Why software is the linchpin of climate tech (and why we need more)

Climate tech is a big umbrella, including everything from an automated crane for long-duration energy storage to an employee benefits platform to help employees go green. I am focussing my attention on B2B software, specifically data intelligence platforms, which is a tiny slice of the climate tech pie and rarely discussed in the broader climate tech conversation, but which I believe can have an outsize impact in de-risking climate capital, increasing energy and carbon performance and catalyzing growth. Why am I bullish on climate tech software? Let me walk you through my reasoning.

The software opportunity for variable renewables

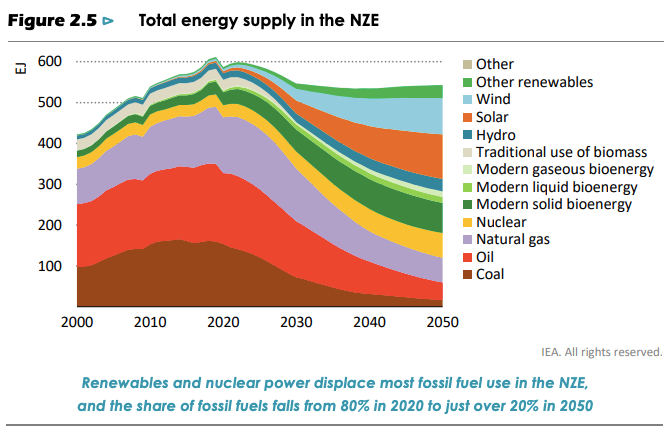

It is safe to assume that getting to net zero emissions over the next 30 years will require a massive sustained capital investment in renewable energy. Solar and wind were already the fastest growing generation sources in 2020, and most current projections expect renewables to make up from 40-60% of our generation base by 2050 (from 12.5% in the US 2020). To get there, many trillions of dollars will be spent every year not only on new generation and distribution, but also the intelligence to direct, manage and optimize that capital expenditure for energy and carbon performance. What are some examples?

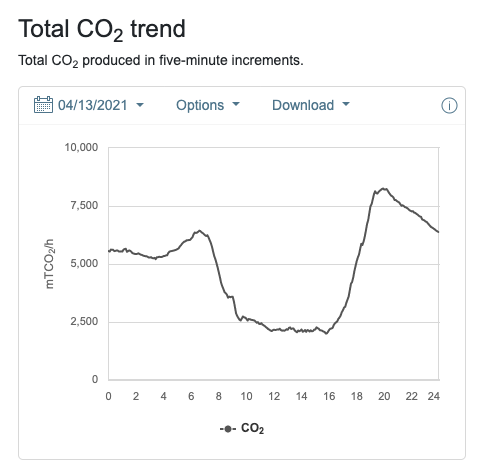

Where I live in California, variable renewables make up ~25% of energy generation and certain sunny days can lead us to produce more solar electricity than we can use. But living with solar and wind means living with generation variability, which can only be dealt with physically by overbuilding capacity or deploying storage, both expensive solutions. Here, intelligence solutions that help to better predict demand and renewables performance can command a large premium, as they reduce the amount of overcapacity and storage that needs to be built. Better modeling using the latest in machine learning and larger data sets can deliver that performance predictability gain.

The variability problem also provides an opening for much greater use of demand management, which today plays a tiny role in our energy system, but in our renewables-heavy future, powered by more distributed energy storage, new shiftable loads and the intelligence/marketplace solutions to manage them, can contribute significantly to reducing peak energy demand. For example, when you own a 100kWh battery in the form of a Ford F150, when does it make sense to use the battery as a primary source of energy for a home? It may pay handsomely to run on battery during times of peak grid load or peak CO2 emissions. With today's time-of-use (TOU) rates in Alameda County, a Powerwall-sized battery can theoretically pay for itself in 7-10 years. The future F150 is priced 50% less per kWh. Buy the battery, get a truck for free. All this is to say that the higher variable renewables mix will increase the value of load shifting to be solved both on the generation and demand sides, and this becomes a software and control systems problem.

We will all speak carbon soon

As much as we want to replace our energy generation and transportation with zero carbon sources today, practically, we are facing a 20-40 year transition period during which we live with a mix of clean and dirty energy. And if you are looking for the best opportunities to reduce carbon in this mixed energy environment, you will focus on carbon efficiency. Carbon efficiency is used to compare activities, investments and companies with carbon emissions as the base. For instance, UPS and FedEx can be compared by their package mile per tonne carbon emitted. Businesses could be compared by their revenue per tonne carbon emitted. During our energy transition, carbon efficiency will be a new currency, and will inform investment and purchase decisions by government, corporations and consumers as well as be used to revalue existing resources and assets. How will this translate in practical terms?

Tracking carbon in investments

We can start at the beginning, where trillions of dollars of capital are being deployed to finance green energy generation. How much carbon will the new generation displace? Developers, financiers, insurance companies and government entities will want to know, and this is a surprisingly difficult question to answer accurately. It is a dynamic systems modeling problem that is historically computationally expensive and relies on data that is often closely held. But with trillions of dollars behind these investments, this type of question will increasingly be asked, which will create the market for more sophisticated modeling software and new data pipelines to answer them.

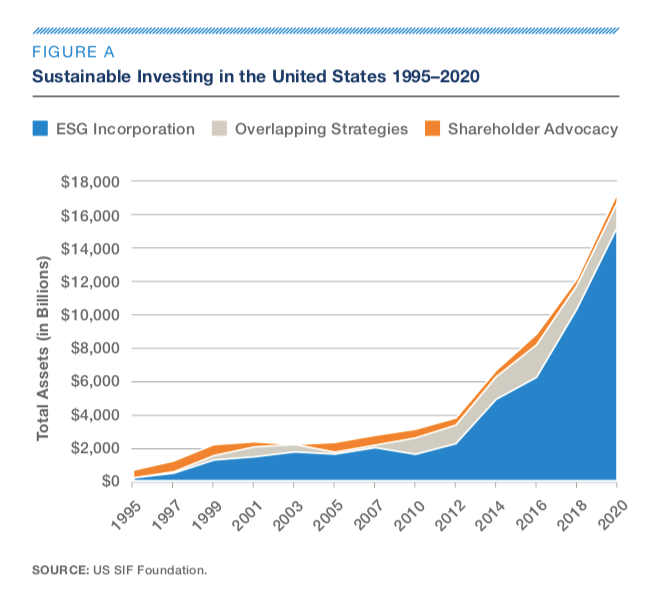

Over the past few years, there has been a boom in what is known as sustainable investing.

The total US-domiciled assets under management using sustainable investing strategies grew from $12.0 trillion at the start of 2018 to $17.1 trillion at the start of 2020, an increase of 42 percent. (US SIF 2020 trends report)

The report continues (emphasis is mine):

This represents 33 percent, or one in three dollars, of the $51.4 trillion in total US assets under professional management.

It's also worth noting that SIF Foundation research found that climate change and carbon emissions are the most important environmental issue among institutional asset holders. But how impactful has this investment activity been in reducing climate change? EDHEC looked into this question and found largely no impact at all. And the Wall Street Journal has reported on how these funds often are indistinguishable from the S&P500 index, except with higher fees. The takeaway here should not be that this is a dead end. Instead, the momentous growth in sustainable funds signals that investor demand is high for corporations to do something about climate change. Then what are the tools that will help investors and corporations actually be effective in reducing corporate carbon footprints? Again, it's new intelligence and data integrations, delivered via new software and services.

Tracking carbon in corporate operations

Good measurement transforms what's being measured. Just recently we have seen a majority of corporations in the Russel 1000 publishing sustainability reports, often including carbon emissions, and the trend is accelerating. The G&A Institute found that "65% of the companies included in the Russell 1000 published sustainability reports in 2019, an increase from 60% in 2018." and "...90% of the largest 500 companies by market cap in the index published sustainability reports in 2019." It's not a stretch to believe that this trend is related to the jump in sustainability focussed investing we saw above. So sustainability reporting is here to stay, but it's a painful process for corporations to endure, gathering data from the far reaches of an organization (as well as suppliers) and the result can be fraught with accuracy issues. Yet another opportunity for new software, one that companies such as Nossa Data are targeting.

You've seen the net zero pledges by corporations. Companies like Microsoft, Google and Unilever have been vocal about achieving net zero carbon emissions, even if general corporate track records have been spotty. Ultimately, the way companies achieve these goals is by tracking carbon from product design and sourcing through disposal, or tracking carbon through its operations and comparing with benchmarked organizations on how to do better. Carbon that can't be avoided through operations is then offset in the voluntary carbon markets, which basically sets a floor on the company's internal price of carbon emissions. There are existing tools here for energy management, life-cycle assessments, etc. but most are first-generation, custom or oriented to handle carbon as an add-on, as I described in this post. New lightweight, cloud-based software and services such as Watershed and Sinai have emerged that will tackle carbon natively and expand access across the corporate market.

Because this post is getting too long, let me leave it here for now and summarize. Next time we will look at the role of software in the new marketplaces, including the one that everyone loves to hate, the carbon offset market.

Summary

We are at the beginning of a massive mobilization of investment in variable renewables, and the 20-40 year transition period of a mixed energy base will create opportunities for software and intelligence solutions as companies, processes, resources and assets are revalued for their carbon efficiency

- Better modeling techniques using greater amounts of data will improve demand forecasting and new renewables siting and performance.

- Corporate adoption of carbon efficiency will be driven by the need to satisfy customer and shareholder expectations as well as EU and progressive US state regulation.

- The carbon emissions data chain is rich, but the data is siloed across countries, companies, departments and government organizations. It is also overly raw, inaccurately derived or highly aggregated without enough standardization. This presents a massive opportunity for data integration and intelligence software.

Interested in hearing more? Please subscribe or follow @greenwashalert