Problems (and product opportunities) in solar, courtesy of the 2021 Solar Risk Report

If you are on the hunt for new product ideas in renewables, a good place to start might be the Solar Risk Assessment published by kWh Analytics. It is a data-rich exploration of problems contributed by analysts from across the solar industry, with each issue crying for better solutions. With $148.6 billion invested in 2020 on new solar projects globally, new tools that deliver even small improvements can translate into sizable value.

Here are some highlights (and select images) from the report, followed by my take in italics.

1) One in eight solar assets chronically underperform P99 estimates

A:Something is wrong here when projects are chronically underperforming against their 1-in-100 downside estimates. Will performance estimates always err on the side of optimism due to structural incentives or is there an opportunity to address these modeling problems on behalf of project sponsors and stakeholders?

2) Solar lags behind wind in deploying digital asset monitoring equipment due to capital constraints, data rights and data integration issues

A: Can capital constraints be eased by creative financing like BlocPower does for building energy improvements? What can asset managers and tools developers negotiating data rights learn from data ownership developments in marketing technology?

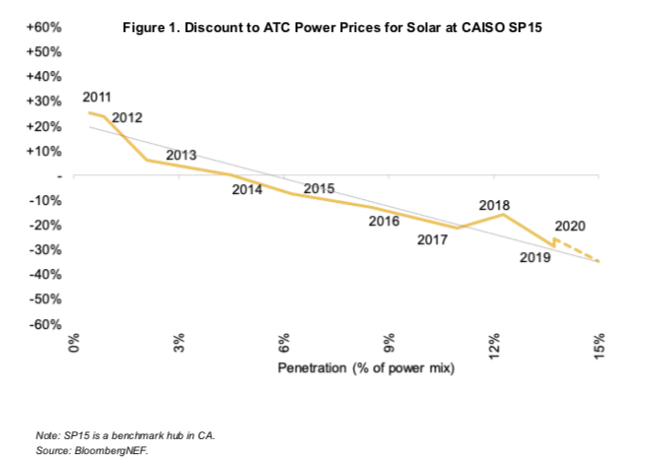

3) 28-35% discounts for solar power compared to average CAISO (California) hub prices, and the discounts are increasing

A: Solar is getting too cheap too quickly for developers to reap their rewards in the wholesale markets -- What are the price points and missing tools to make it possible for developers to pair more storage capability with solar projects?

4) Inverter failures are the leading cause of performance-related plant tickets, and the time to repair these devices averages 7 days, but can exceed 60 days

A: How can additional data collection with machine learning improve predicting these failures, like has been done for hard drives in data centers?

5) Estimates for soiling (when solar panels get dirty) have a 99.5% error rate

A: Seeing a square distribution pattern where we should see a line is never good. Here’s another opportunity for a better modeling approach that can save asset managers from cash flow and op ex hits from unexpectedly high cleaning budgets.

6) Wildfire and extreme weather events not well incorporated in most performance modeling

A: Wildfire smoke and hail damage severely impacted performance in 2019-2020. Performance models need to incorporate better extreme weather event models that go beyond projections of historical patterns. Perhaps this is a good place to incorporate contemporary methods to feature uncertainty.

7) Insurance acquisition and claims paperwork is increasing the overhead of asset managers, raising op ex

A: Increasing insurance costs and management overhead are a drag on new project investment and existing project profitability. This looks like a great marketplace and workflow automation opportunity.

If any of this sounds interesting, I encourage you to read the kWh report in full. Data and software are recurring themes in how we can address these issues, illustrating my argument for the outsize impact that software can deliver in tackling climate change.

Are you a vendor tackling one of these issues or an entrepreneur or investor interested in this space? Are you working in the industry and want to offer more background on the existing tools? I’d love to speak with you! Reach me at art@paraclimate.com.

Interested in hearing more? You can subscribe here.